Have you ever felt overwhelmed staring at a blank page, trying to craft the perfect resume? You’re not alone. In today’s competitive job market, especially in the financial sector, your resume is more than just a list of jobs; it’s your ticket to standing out.

Imagine a hiring manager sifting through dozens of applications, searching for that one standout candidate. What if your resume could grab their attention in mere seconds? This guide will help you navigate the nuances of creating a financial analyst resume for 2024, highlighting fresh strategies and insights that can set you apart from the crowd. Let’s immerse and turn your resume into a powerful tool that showcases your skills and potential.

Key Responsibilities of a Financial Analyst

As a financial analyst, you engage in several vital tasks that contribute significantly to an organization’s financial health.

Financial Reporting and Analysis

You perform day-to-day activities related to financial reporting. This includes month-end closing activities, account reconciliations, and General ledger maintenance. Preparing and analyzing financial reports is crucial. You’ll create balance sheets, income statements, and cash flow statements that provide a clear picture of the company’s financial standing. Accuracy here is key; any miscalculation can lead to misinformed decision-making.

Data Analysis and Modeling

Conducting data analysis forms the backbone of your role. By identifying trends, you optimize processes and contribute to informed financial decisions. You highlight your proficiency in essential tools, such as Microsoft Excel and SQL, as well as financial modeling software. These skills enhance your capability to analyze large data sets efficiently, generating insights that drive strategic initiatives.

Budget Management and Forecasting

In budget management, you develop and oversee budgets, creating financial forecasts that support strategic planning. It’s essential to emphasize your contributions toward improving forecasting accuracy and budget optimization. Accurate forecasts empower businesses to allocate resources effectively.

Financial analysts play a multifaceted role. Your responsibilities are interconnected, and excelling in one area often benefits others. By showcasing these key responsibilities on your resume, you align your experience with employer expectations, enhancing your appeal in the competitive job market.

Important Skills for Financial Analyst Resumes

When crafting your financial analyst resume for 2024, it’s vital to emphasize the right skills. Both technical and soft skills play a critical role in your job application. Highlight relevant certifications and qualifications to enhance your credibility.

Technical Skills

Technical skills form the backbone of your resume. Proficiency in financial modeling, data analysis, and statistical software is essential. Employers expect candidates to demonstrate expertise in tools like Excel, SQL, Python, and R. These skills allow for effective financial modeling and insightful data analysis. Familiarity with financial software, including SAP and Oracle, stands out in your application. Consider mentioning your experience with advanced functions in Microsoft Excel, which shows your ability to handle complex data. Data visualization skills using tools such as Tableau or Power BI add significant value. These applications help translate data into actionable insights for stakeholders. Proficiency in programming languages specifically tailored for financial tasks, like Python or R, is crucial too. By showcasing these technical skills, you position yourself as a knowledgeable candidate.

Soft Skills

Soft skills are just as important as technical abilities. They often distinguish you from other applicants. Strong communication skills enable you to present complex financial data clearly and persuasively. Think about the impact of effective teamwork; collaborating with cross-functional teams can lead to innovative solutions. Also, problem-solving skills showcase your ability to navigate challenges and find solutions efficiently. Analytical thinking is critical; it empowers you to interpret data meaningfully. Adaptability is another essential trait, enabling you to thrive in a fast-paced financial environment. Are you comfortable working under pressure? This capability can reflect your resilience and commitment to meeting deadlines. By emphasizing these soft skills, you demonstrate your overall fit for the role.

Certifications and Relevant Qualifications

Certifications and qualifications bolster your professional profile. Consider acquiring financial analyst certifications such as CFA (Chartered Financial Analyst) or CPA (Certified Public Accountant). These credentials exhibit your commitment to excellence and adherence to industry standards. Relevant qualifications, including a degree in finance, accounting, or economics, further solidify your foundation. Also, workshops and professional courses related to data analysis or financial modeling can enhance your expertise. Have you considered enrolling in online courses? Platforms like Coursera or LinkedIn Learning offer valuable opportunities to expand your skill set. By mentioning these certifications and qualifications on your resume, you increase your attractiveness to potential employers.

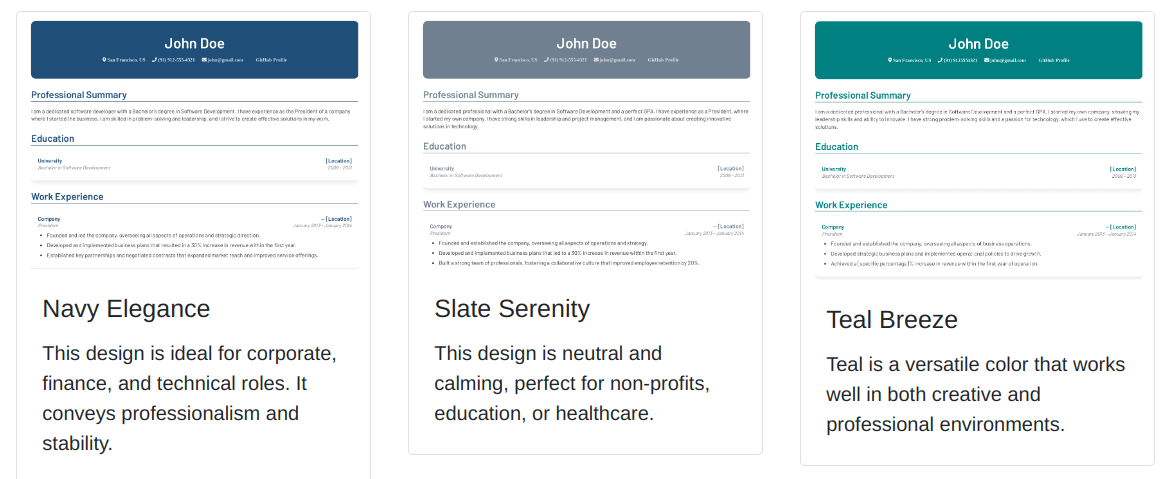

Types Of Resume Templates For Financial Analysts

Selecting the right resume template is vital for presenting your skills effectively in the financial sector. The template you choose can influence how potential employers perceive your qualifications and experiences. Here are the primary types of resume templates suited for financial analysts.

Chronological Resume Templates

Chronological resume templates are a popular choice among financial analysts. This approach showcases your professional history in reverse chronological order, emphasizing your most recent job first. Such a format clearly highlights your career progression, making it easy for employers to spot advancements and relevant experiences. You can illustrate your achievements and responsibilities effectively, providing a focused narrative of your growth over time. For senior professionals, this template often proves particularly advantageous, as it demonstrates a long-standing commitment to the field and showcases substantial accomplishments.

Functional Resume Templates

Functional resume templates prioritize skills over chronological work history. This style allows you to highlight pertinent skills and competencies first, making it useful for those who may have gaps in their employment history or are transitioning into financial analysis from other fields. By categorizing skills relevant to financial analysis—like data modeling or financial forecasting—you can craft a compelling profile that draws attention to your capabilities. This format encourages employers to focus on what you can bring to the table rather than solely assessing your previous roles.

Combination Resume Templates

Combination resume templates blend the benefits of both chronological and functional formats. They allow you to present your skills at the top, followed by a chronological list of your work experience. This structure provides a comprehensive view of your qualifications while retaining a clear timeline of your professional journey. Such a format can be highly effective for those who possess both significant experience in financial analysis and a robust skill set, as it showcases your expertise and your career progression simultaneously. This approach not only captivates attention but also conveys depth and versatility.

Consider what suits your background and career goals best. The right choice can enhance your resume’s effectiveness and improve your chances of landing that ideal financial analyst position in 2024.

How to Write an Effective Resume Summary for a Financial Analyst

An impactful resume summary serves as your professional calling card. It encapsulates your skills, experience, and achievements in a concise format that grabs hiring managers’ attention.

Tips for Crafting a Compelling Summary

- Start with Key Information: Begin with your professional title and years of relevant experience. For example, “Senior Financial Analyst with 6+ years of experience.” This immediately establishes your credibility.

- Highlight Achievements: Specify quantifiable accomplishments that showcase your impact. Consider phrases like, “Drove cost savings of over 12% at Company Y by streamlining processes.” Data-driven achievements capture your effectiveness.

- Emphasize Relevant Skills: Clearly list crucial skills pertinent to the role. Mention abilities such as financial modeling, data analysis, and risk management. Including skills reinforces your suitability for the job.

- Align with Job Requirements: Incorporate keywords from the job description, hinting at your compatibility with the role. Tailoring language in your summary helps you resonate with potential employers.

- Sample Summary for an Entry-Level Analyst: “Detail-oriented Financial Analyst with a solid foundation in data analysis and financial modeling. Proficient in Excel and VBA, I bring strong analytical skills and a commitment to delivering accurate financial insights.”

- Sample Summary for a Mid-Level Analyst: “Results-driven Financial Analyst with 8 years in budgeting and forecasting. Expert in financial reporting and variance analysis, I successfully improved forecasting accuracy by 15% at Company Z, enhancing decision-making processes.”

- Sample Summary for a Senior Analyst: “Strategic Senior Financial Analyst with over 10 years of experience in risk management and investment strategy. Skilled in data visualization and advanced financial modeling, I led cross-functional teams to achieve a revenue growth of 20% year over year.”

Each example showcases distinct levels of experience while underscoring the importance of specificity and alignment with job requirements. By crafting a strong summary, you stand out in a competitive market.

Work Experience Section for a Financial Analyst Resume

The work experience section holds significant importance on your financial analyst resume. This section provides a platform to showcase not only what you’ve done but also the impact you’ve made. It highlights your qualifications and can set you apart from other candidates.

How to Highlight Relevant Experience

To effectively highlight relevant experience, adopt a reverse chronological format. Start with your most recent role and work backward. Ensure each position clearly states your job title, the company name, and the dates you worked there.

Use active verbs to describe your responsibilities and accomplishments. For example, instead of stating “Responsible for financial reporting,” state “Managed financial reporting, leading to improved accuracy.” Quantify your achievements where possible. Numbers can illustrate your accomplishments, like “Increased revenue by 15% through strategic cost analysis.” This provides concrete evidence of your contributions.

Consider incorporating keywords from the job description, as many applicant tracking systems filter applications. Tailoring this section to match the specific requirements of the position enhances chances of passing initial screenings. This attention to detail demonstrates your commitment and understanding of the role.

Examples of Impactful Bullet Points for Financial Analyst Roles

Creating impactful bullet points is crucial for demonstrating your value. Here are several examples to consider:

- Improved Budget Accuracy: “Enhanced budget accuracy by 25%, allowing for better resource allocation across departments.”

- Streamlined Reporting Processes: “Streamlined reporting processes, reducing report generation time by 30%, which significantly improved decision-making efficiency.”

- Conducted Data Analysis: “Conducted in-depth data analysis, identifying trends that resulted in actionable insights and a 20% increase in quarterly profits.”

- Developed Financial Models: “Developed complex financial models that projected key business outcomes, influencing strategic planning and investment decisions.”

Each bullet point should demonstrate a specific accomplishment. Aim for clarity and avoid jargon. Remember, conveying your contributions in a clear, concise manner captures attention and showcases your potential impact as a financial analyst.

Highlighting Achievements Instead of Responsibilities

Focusing on achievements transforms your resume from a simple list of tasks into a powerful document that showcases your unique value. This approach not only demonstrates what you can do but also highlights how you’ve positively impacted your previous organizations.

Why Focusing on Accomplishments Is Important

Emphasizing accomplishments showcases your ability to deliver results. Employers seek candidates who have a proven track record of success. By using quantifiable metrics, you create evidence that illustrates your capabilities. For example, instead of stating that you managed budgets, you might mention that you reduced expenses by 15% while maintaining service quality. Such specifics catch the eye of hiring managers and position you as a standout candidate.

Imagine the difference it makes when you illustrate your contributions through achievements rather than responsibilities. Highlighting improved efficiency, cost savings, or revenue increases demonstrates your proactive approach to problem-solving. Achievements show how you go beyond the basic requirements, revealing your potential to add significant value.

Examples of Achievements Relevant to Financial Analyst

Here are specific examples of accomplishments that emphasize your skills:

- Increased Revenue: By developing a financial model that accurately projected quarterly revenues, you helped your company achieve a 20% increase in sales.

- Enhanced Reporting Efficiency: Streamlined the reporting process, reducing the time taken for monthly reports from ten days to five. This change allowed for quicker decision-making.

- Optimized Budgets: Identified areas of waste and saved the organization $50,000 annually through strategic budget management.

- Improved Data Accuracy: Implemented a new data validation process that decreased errors in financial reporting by 30%. This not only improved accuracy but also enhanced stakeholder trust.

- Successful Forecasting: Created forecasting models that predicted market trends, enabling the team to adjust strategies, increase profits by 10%, and mitigate risks.

Highlighting achievements like these illustrates your competence and readiness to tackle challenges. It positions you as a results-oriented professional, making it easier for potential employers to envision your contributions to their teams. Have your achievements ready when updating your resume, as they serve as critical differentiators in a competitive job market.

Education Section for a Financial Analyst Resume

The education section of your financial analyst resume plays a crucial role in demonstrating your qualifications and credibility. Focus on significant degrees and relevant certifications that can set you apart from the competition.

Recommended Qualifications

A bachelor’s degree in a relevant field, such as finance, business, economics, or accounting, is essential for most financial analyst positions. For more advanced roles, pursuing a master’s degree can enhance your appeal. Are you considering certifications? Options like the Chartered Financial Analyst (CFA), Certified Public Accountant (CPA), or Financial Modeling and Valuation Analyst (FMVA) hold significant weight in this field. They showcase your expertise and commitment to professional development.

How to Present Educational Background Effectively

When presenting your educational background, clarity is vital. Start by clearly stating the degree earned, such as “Bachelor of Science in Finance,” followed by the institution’s name, for example, “Chicago University.”

Incorporate graduation dates for added context. You might include a range like “August 2013 – May 2017.” If your GPA is impressive—3.0 or higher—display it prominently. This information makes your application more compelling and shows your academic diligence.

Use bullet points or apply simple designs to enhance readability. You want to ensure that hiring managers can easily scan this section. Remember, your educational background is essential, and presenting it effectively can capture positive attention from potential employers.

Additional Sections for Financial Analyst Resumes

In building a compelling financial analyst resume, incorporating additional sections can set you apart. Consider the following critical elements that enhance your application’s appeal.

Certifications

Including certifications on your resume highlights your qualifications and dedication to the finance field. Notable certifications encompass the Chartered Financial Analyst (CFA), Certified Financial Planner (CFP), and Financial Modeling and Valuation Analyst (FMVA). Each credential reflects specialized knowledge and expertise, which hiring managers value highly. Create a distinct section titled “Certifications” where you list these elements concisely. For each entry, include the certificate title, issuing organization, and the date received. Doing so can instantly convey your commitment to ongoing education and professional development.

Languages

Proficiency in multiple languages can significantly boost your resume’s attractiveness. In today’s global market, companies often seek candidates with diverse language skills. Include the languages you speak, and specify your level of proficiency, such as Fluent, Intermediate, or Native. By providing this information, you give potential employers confidence in your ability to communicate with diverse clients and teams. Also, consider separating each language into its own bullet point for clarity, making it easy for hiring managers to scan this vital information quickly.

Awards and Honors

Showcasing relevant awards and honors can elevate your resume and demonstrate your achievements. Consider including accolades such as “Employee of the Month,” “Top Analyst Award,” or “Best Financial Report” to present quantifiable recognition. Each accolade reflects your capability and hard work in the financial sector. Position this section strategically, placing it after your work experience or education, to capture attention following major qualifications. Highlighting these honors can help you stand out as a well-recognized candidate.

Relevant Projects

Describing relevant projects provides concrete examples of your skills and experience. In this section, summarize specific projects that you have led or contributed to, focusing on their impact and results. For instance, you might mention your role in developing a budgeting model that reduced costs by 15%. Detailing project outcomes and your contributions adds depth to your resume and illustrates your capacity for delivering measurable results. Consider formatting this section as brief narratives or bullet points that encapsulate your role, the project’s significance, and the skills you applied. By doing this, you clearly demonstrate your analytical capabilities and initiative.

Financial Analyst Resume Sample

Creating an effective financial analyst resume requires a clear structure. Consider the following sample as a guide:

[Your Name]

[Your Address]

[City, State, Zip]

[Your Phone Number]

[Your Email Address]

Professional Summary

Dynamic financial analyst with 6 years of experience specializing in financial reporting and data analysis. Proven track record of optimizing costs by 12% at Company Y through streamlined processes. Demonstrates expertise in forecasting and risk management, holding a CPA certification.

Professional Experience

Senior Financial Analyst

Company X, City, State | Month Year – Present

- Led financial reporting and analysis initiatives, contributing to accurate forecasts that informed executive decisions.

- Managed budget processes, ensuring alignment with strategic goals.

- Developed and implemented data models, enhancing predictive analytics for better investment strategies.

Financial Analyst

Company Y, City, State | Month Year – Month Year

- Analyzed financial data to identify trends and improve decision-making processes.

- Collaborated with cross-functional teams to streamline reporting procedures.

- Implemented cost-saving measures that decreased expenditures by 12%, using comprehensive financial modeling techniques.

Education

Bachelor of Science in Finance

University Name, City, State | Month Year

Certifications

- Certified Public Accountant (CPA)

- Chartered Financial Analyst (CFA)

Skills

- Financial Modeling

- Data Analysis with Excel and SQL

- Risk Management

- Strong Communication

- Problem-Solving

- Recognized for Outstanding Achievement Awards at previous roles.

- Proficient in Spanish, enhancing collaboration with diverse teams.

This sample not only showcases your qualifications but also highlights your achievements. If you can convey measurable impacts and relevant skills, you’ll create a compelling resume that attracts attention from hiring managers. Remember, always tailor your resume to the specific job to which you’re applying, ensuring that it aligns with their expectations.

Tips for Optimizing Your Financial Analyst Resume for ATS

Optimizing your financial analyst resume for Applicant Tracking Systems (ATS) heightens your chances of standing out in the hiring process. You should focus on effectively integrating keywords and addressing common ATS-related mistakes.

How to Use Keywords Effectively

Use keywords tailored to the financial analyst role. First, analyze job descriptions for specific skills and qualifications relevant to the position you’re applying for. For example, if the job posting mentions “data analysis” or “financial modeling,” include these terms in your resume.

Incorporate these keywords naturally in your summary, work experience, and skills sections. For instance, instead of writing “responsible for financial analysis,” say “executed financial analysis using advanced data modeling techniques.” This approach helps demonstrate your fitting qualifications while avoiding keyword stuffing, which can lead to rejection.

Metrics also enhance keyword usage. Use quantifiable results where applicable. Phrases such as “increased efficiency by 20%” or “managed budgets of over $500,000” can resonate well with ATS.

Avoiding Common ATS-Related Mistakes

Several common mistakes can diminish your resume’s effectiveness within ATS. First, don’t use unconventional formats. Stick with standard formats such as .docx or PDF, as some software may not read other file types correctly. Ensure your font is clear and simple; complex fonts may confuse ATS.

Secondly, refrain from overly creative designs, including graphics and images. While modern designs may appeal to hiring managers, they can disrupt ATS parsing and lead to your qualifications being overlooked. Instead, aim for a clean layout with clearly defined sections.

Finally, be cautious with acronyms. Always spell them out on first use. For example, write “Certified Public Accountant (CPA)” when you first mention it, and then use “CPA” thereafter. This dual approach guarantees the ATS recognizes your credentials.

Adhering to these strategies will maximize your resume’s compatibility with ATS, significantly increasing your visibility to hiring managers.

Common Mistakes to Avoid in a Financial Analyst Resume

When crafting your financial analyst resume, it’s essential to steer clear of certain pitfalls that can diminish your chances of standing out. Mistakes in your resume can lead to missed opportunities. Here are the most common errors to avoid:

Lack of Clear and Concise Summary

A powerful resume deserves a compelling summary. This section must highlight your job title, years of experience, key achievements, and top skills. Vague statements weaken your impact. Instead of saying, “I’m a skilled analyst,” present yourself with clarity: “Seasoned Financial Analyst with over 5 years of experience in developing financial models and enhancing profitability through data analysis.” This approach grabs attention and immediately communicates your qualifications.

Poorly Structured Work Experience

Ensuring a well-structured work experience section is vital. Organize your roles in reverse chronological order. Each entry should clearly state your title, the company name, and the dates you were employed. Always include 3-5 specific responsibilities and achievements. For instance, rather than stating, “Conducted financial analyses,” elaborate with, “Conducted financial analyses leading to a 15% reduction in operating costs.” This method quantifies your impact and demonstrates relevance, giving hiring managers tangible evidence of your contributions.

Insufficient Quantification of Achievements

Numbers speak volumes in your resume. Incorporate quantifiable achievements wherever possible. If you increased revenue, state the percentage or amount. Similarly, if you improved efficiency, share the metrics. This level of detail showcases your capabilities and sets you apart from less-detailed candidates. For example, “Reduced forecasting errors by 20% through rigorous data modeling” provides a clear picture of your valuable impact.

Using an Improper Template

Selecting the right template can make or break your application. Avoid overly creative or unconventional designs that may confuse hiring managers or Applicant Tracking Systems (ATS). Instead, opt for a clean, professional format that enhances readability. A chronological or combination resume template often works best in the financial field. This strategy not only highlights your skills effectively but also ensures ATS compatibility.

Ignoring Skill Relevance

Tailoring your skills section to reflect the job description increases your chances of passing ATS screenings and catching the eye of hiring managers. Focus on both technical skills, such as proficiency in Excel and data analysis, and essential soft skills, including problem-solving and analytical thinking. Highlight specific software and tools you’ve effectively used in your roles. This customized approach shows you understand the job requirements and possess the necessary skills.

Neglecting to Include Certifications

Certifications are not mere decorations on your resume; they validate your expertise. Include relevant qualifications, such as CFA or CPA, to enhance your appeal. This additional layer of professionalism signals your commitment to the finance field. Listing your relevant certifications can distinguish you from other applicants vying for the same position.

By keeping these common mistakes in mind, you can refine your financial analyst resume and enhance your appeal in the competitive job market. Focusing on clarity, structure, quantifiable achievements, proper formatting, relevant skills, and certifications can provide you with a solid advantage in your job search.

Cover Letter Tips for Financial Analyst

A strong cover letter enhances your resume, providing a compelling narrative about your qualifications. It’s your chance to showcase your personality and articulate your passion for the finance industry.

How to Write a Cover Letter That Complements Your Resume

Begin with a professional salutation, addressing the hiring manager by name if possible. Craft an engaging opening paragraph that immediately grabs attention. Explain why you’re interested in the position and the company. This sets the tone for the rest of the letter and demonstrates your enthusiasm.

Next, highlight your relevant experiences and skills in the body. Use specific examples to illustrate your achievements. Describe how you utilized financial modeling skills to improve a company’s profitability. This provides concrete evidence of your value, making your application more persuasive.

Remember to connect your qualifications to the job description. Discuss how your background aligns with the requirements of the position. This shows that you understand what the employer seeks and that you’re a suitable candidate. Also, include any relevant certifications like CFA or CPA to emphasize your commitment to financial expertise.

Conclude with a strong closing statement. Express your eagerness to discuss your application in more detail during an interview. Don’t forget to thank the reader for their consideration. A polite closing leaves a lasting impression.

Cover Letter Example for a Financial Analyst

[Your Name]

[Your Address]

[City, State, Zip]

[Your Email]

[Your Phone Number]

[Date]

[Hiring Manager’s Name]

[Company’s Name]

[Company’s Address]

[City, State, Zip]

Dear [Hiring Manager’s Name],

I am writing to express my interest in the Financial Analyst position at [Company’s Name]. With five years of experience specializing in data analysis and financial reporting, I bring a proven track record of delivering actionable insights that drive business growth.

In my previous role at [Previous Company], I led a project that improved forecasting accuracy by 20%, utilizing advanced statistical techniques and financial modeling. Collaborating with cross-functional teams allowed me to develop a keen understanding of business operations, aligning financial strategies with organizational objectives. Also, my proficiency in Excel and SQL enables me to analyze complex datasets efficiently.

I am particularly impressed by [Company’s Name] commitment to innovation and excellence in the finance sector. I am eager to contribute my analytical skills and strategic insights to enhance your team’s performance and support your organizational goals.

Thank you for considering my application. I look forward to discussing how my background and skills can benefit [Company’s Name].

Sincerely,

[Your Name]

By following these tips and utilizing this example, you can create a cover letter that effectively complements your resume and strengthens your overall application.

Key Takeaways

- Tailored Resumes are Key: Customize your resume by aligning it with the specific job description, focusing on relevant skills and achievements that cater to financial analyst roles.

- Highlight Important Skills: Emphasize both technical skills, such as financial modeling and data analysis, and soft skills, including communication and problem-solving, to showcase your overall capability.

- Quantify Achievements: Use measurable results to highlight your impact on previous roles. This practice demonstrates your effectiveness and makes your contributions stand out.

- Choose the Right Format: Select an appropriate resume template – chronological, functional, or combination – to present your experience clearly and effectively based on your career stage.

- Include Certifications and Education: List relevant qualifications, certifications (like CFA or CPA), and education to enhance your credibility and signal your dedication to the finance field.

- Optimize for ATS: Incorporate keywords from job postings and avoid complex formatting to ensure your resume is easily read by Applicant Tracking Systems, improving your chances of getting noticed by hiring managers.

Final Thoughts

Crafting a standout financial analyst resume in 2024 is crucial for making a lasting impression in a competitive field. By focusing on key responsibilities skills and achievements you can create a resume that resonates with hiring managers. Remember to tailor your resume to each job application and use the right format to showcase your strengths effectively.

Don’t overlook the importance of a compelling cover letter that complements your resume and highlights your unique qualifications. By avoiding common pitfalls and following the strategies outlined in this guide you can enhance your chances of landing that desired financial analyst position. Embrace the process and let your resume reflect your potential in the finance industry.

Frequently Asked Questions

What is the main focus of the article?

The article focuses on strategies for crafting effective financial analyst resumes, emphasizing the challenges of standing out in the competitive financial sector. It provides insights for highlighting skills, responsibilities, and accomplishments that align with employer expectations.

Why is a resume important for financial analysts?

A resume is crucial for financial analysts as it serves as the primary tool to showcase skills, experiences, and achievements to hiring managers, helping candidates stand out among a large pool of applicants.

What key responsibilities should be highlighted in a financial analyst resume?

Key responsibilities to highlight include financial reporting and analysis, data modeling, budget management, and forecasting. Emphasizing accuracy and data-driven decision-making is essential for attracting potential employers.

What skills are important for financial analysts to include in their resumes?

Financial analysts should emphasize both technical skills, such as financial modeling and data analysis, and soft skills like communication, teamwork, and analytical thinking to showcase their well-rounded capabilities.

What types of resume templates are recommended for financial analysts?

The article recommends three main types of resume templates: chronological, functional, and combination. Choosing the right template based on career goals and experiences can enhance a candidate’s appeal.

How should candidates craft their resume summary?

Candidates should create a concise resume summary that highlights relevant skills, experiences, and achievements tailored to the job they are applying for. It serves as a strong introduction to the applicant’s qualifications.

What is the significance of quantifying achievements in a resume?

Quantifying achievements helps to demonstrate impact and effectiveness in previous roles, making a candidate’s experience more relatable and credible to potential employers.

How can candidates optimize their resumes for Applicant Tracking Systems (ATS)?

Candidates can optimize their resumes for ATS by incorporating relevant keywords from job descriptions naturally, and by avoiding overly creative formats that may hinder system parsing.

What common mistakes should candidates avoid when writing their resumes?

Common mistakes include using unclear summaries, failing to quantify achievements, choosing improper templates, and neglecting to tailor skills sections to match job descriptions.

What additional elements can enhance a financial analyst resume?

Including certifications, language proficiency, awards, and relevant projects can further differentiate candidates and present a more comprehensive professional profile to employers.