Have you ever wondered what sets apart a standout accountant resume from the rest? As the job market evolves, so do the expectations for your resume. In 2024, it’s not just about listing qualifications; it’s about telling your unique story and showcasing your value in a way that grabs attention.

Imagine a hiring manager sifting through countless resumes, each looking similar and uninspired. Now picture yours—vibrant, tailored, and packed with the skills and experiences that make you the perfect fit. This guide will unveil fresh insights and strategies to help you craft a compelling resume that not only highlights your expertise but also resonates with employers in today’s competitive landscape. Get ready to transform your resume into a powerful tool that opens doors to your dream accounting role.

Key Responsibilities of a Accountant

Accountants play a vital role in maintaining financial health and compliance within organizations. Understanding these key responsibilities will enhance your resume, showcasing your expertise and alignment with industry expectations.

- Financial Reporting: You prepare precise financial statements such as balance sheets, income statements, and cash flow statements. These documents provide crucial insights into an organization’s financial status.

- Budgeting: You develop and manage budgets, ensuring alignment with strategic goals. This involves analyzing variances, forecasting financial outcomes, and recommending corrective actions to support fiscal stability.

- Tax Preparation: You handle tax filings and ensure compliance with local, state, and federal regulations. Knowledge of tax codes and laws is essential for minimizing liabilities and avoiding penalties.

- Auditing: You conduct internal and external audits to assess financial operations. This process identifies discrepancies, ensures adherence to regulations, and enhances overall financial integrity.

- Financial Analysis: You perform comprehensive financial analyses to inform decision-making. Utilizing tools like Microsoft Excel and QuickBooks, you assess trends, identify areas for improvement, and present actionable recommendations.

- Documentation and Record Keeping: You maintain meticulous records of all financial transactions. This supports transparency and provides an essential audit trail for tax and compliance purposes.

- Consulting and Advising: You often serve as a trusted advisor to management. Whether it’s recommending the best practices for cost control or strategizing for investments, your insights drive financial decisions.

What does it take to excel in these responsibilities? Strong attention to detail, analytical skills, and effective communication must be at the forefront of your capabilities. Diverse tasks require adaptability and a commitment to continuous learning, especially given the evolving financial landscape. Importantly, embracing technology and keeping abreast of industry trends can set you apart in this competitive field.

Important Skills for Accountant Resumes

Accountants must exhibit a blend of technical skills and soft skills to thrive in their roles. These competencies not only enhance your value but also make your resume appealing to potential employers. Here’s a breakdown of the essential skills for 2024 accountant resumes.

Technical Skills

Proficiency in accounting software is non-negotiable. Familiarity with tools like QuickBooks, Microsoft Excel, and SAP stands out on resumes. Employers crave experts who can seamlessly navigate platforms such as Oracle Financials, Xero, FreshBooks, and Wave Accounting. Financial reporting and analysis skills also matter. Demonstrating your ability to forecast budgets, conduct financial modeling, and analyze data can make a significant impact. Also, an in-depth understanding of Generally Accepted Accounting Principles (GAAP) is critical. It shows you recognize and comply with regulatory standards—an aspect highly valued in the field.

You must also grasp audit and compliance requirements. Knowledge of audit software, such as ACL or IDEA, indicates preparedness for meticulous examination processes. Payroll management skills add further depth to your qualifications. Proficiency in payroll software, alongside experience with accounts payable, receivable, and General ledger accounting, forms a well-rounded technical foundation.

Soft Skills

While technical expertise is vital, soft skills cannot be overlooked. To communicate effectively, you should foster strong interpersonal skills. Think about it: accountants often collaborate with teams and interact with clients. Empathy and active listening capabilities foster trust and understanding.

Problem-solving skills enhance your effectiveness in addressing financial discrepancies or strategic challenges. Are you adaptable? In a fast-paced industry, the ability to pivot and embrace changes can set you apart. Attention to detail is essential; a small mistake in accounting can lead to significant consequences. Cultivate a mindset focused on precision and thoroughness.

Also, organizational skills contribute to efficient workflows. Managing multiple tasks simultaneously requires effective prioritization and time management. The right balance of soft skills can transform you from a competent accountant to a remarkable one.

Certifications and Relevant Qualifications

Certifications serve as proof of your commitment to the profession. Aim for relevant qualifications such as Certified Public Accountant (CPA) or Chartered Accountant (CA). Holding these certifications not only improves your credibility but also expands your knowledge base.

Also, consider obtaining certifications in specialized areas, like forensic accounting or tax preparation. These qualifications can enhance your marketability significantly. Relevant coursework in finance, accounting, or business administration not only builds a solid foundation but also enriches your expertise.

What do you wait for? Invest in your professional development by pursuing certifications and continuously updating your qualifications. Doing so positions you as an informed candidate, dedicated to excellence in the accounting field.

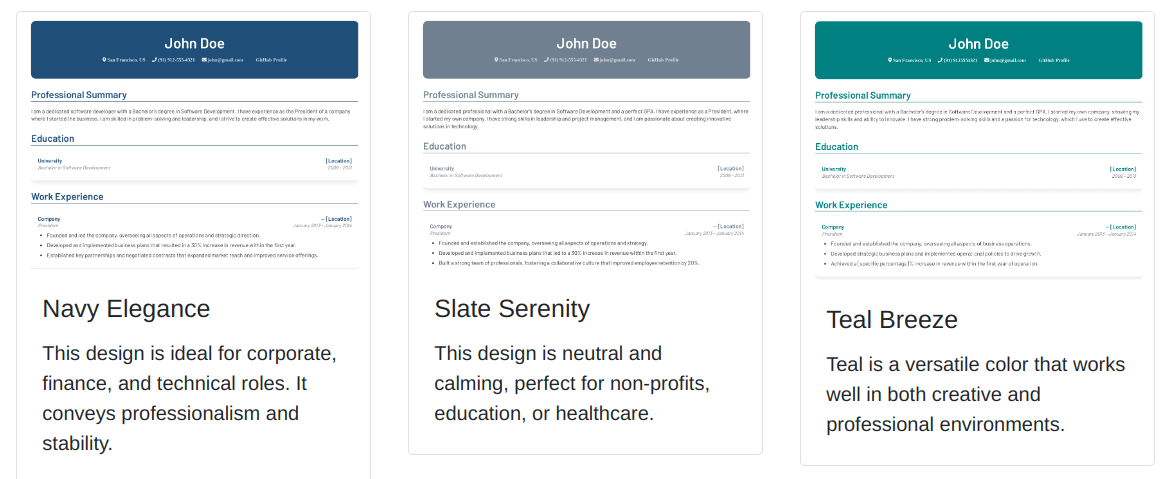

Types Of Resume Templates For Accountants

Choosing the right resume template significantly impacts your chances of standing out as an accountant. Understanding the various types of templates available helps in selecting one that best showcases your skills and experiences.

Chronological Resume Templates

Chronological resume templates present your work history in reverse order, starting with the most recent position. This format effectively emphasizes your career progression and relevant experience. But, if you have gaps in employment or are transitioning to a new field, this template may not be your best option. It focuses heavily on job titles and dates, which can overshadow your skills and qualifications. You might consider this format if your experience aligns closely with the job requirements and demonstrates continuous professional growth.

Functional Resume Templates

Functional resume templates center around your skills and achievements rather than your employment history. They allow you to highlight technical competencies and certifications, crucial elements for accountants. This approach can be beneficial if you’re shifting careers or returning to the workforce after a break. Nevertheless, some employers prefer a clearer view of your career path, leaving functional templates less favorable for applicants with a strong traditional background. If your qualifications are compelling and relevant, this format offers a chance to present a tailored narrative.

Combination Resume Templates

Combination resume templates merge the strengths of both chronological and functional formats, offering a balanced view of your skills and work history. This versatility allows you to highlight your qualifications upfront while providing a detailed account of your professional experience. For accountants, this format proves advantageous, especially if you possess both relevant skills and a solid work history. How can you leverage this format? By emphasizing the skills most relevant to the job while maintaining a clear timeline of your career path, you create a comprehensive picture of your capabilities.

How to Write an Effective Resume Summary for a Accountant

An effective resume summary showcases your unique qualifications as an accountant. A compelling summary captures the attention of recruiters and emphasizes your key achievements.

Tips for Crafting a Compelling Summary

- Keep It Concise: Aim for a summary that spans 3-4 sentences. Brevity lets recruiters quickly assess your qualifications.

- Focus on Achievements: Highlight specific accomplishments instead of simply listing duties. Mention how you improved efficiencies, such as driving cost savings of 15% in a fiscal year or leading a successful tax audit that resulted in zero discrepancies.

- Use Relevant Keywords: Incorporate keywords from the job description. This tactic helps your resume pass through Applicant Tracking Systems (ATS) and increases visibility to hiring managers. For an accountant position, relevant keywords might include “financial analysis,” “GAAP compliance,” or “budget management.”

- Tailor to the Job: Customize your summary for each application. Emphasize the skills and experiences most applicable to the role you’re pursuing. For example, if the job focuses on tax preparation, highlight your background in managing corporate taxes and compliance.

- Example 1: “Detail-oriented CPA with over 5 years of experience in financial reporting and tax compliance. Achieved a 20% reduction in annual tax liabilities through strategic planning. Proficient in QuickBooks and ERP software, ensuring accuracy in all financial statements.”

- Example 2: “Dynamic accountant skilled in budgeting and financial analysis, with a track record of enhancing operational efficiencies. Successfully implemented a new financial reporting system, resulting in a 30% decrease in month-end closing time.”

- Example 3: “Results-driven accounting professional with a knack for problem-solving and attention to detail. Managed a portfolio of clients, ensuring compliance with GAAP regulations while improving client retention scores by 40%.”

Adopting these tips and examples enhances your resume summary. Make it a powerful tool that reflects your professional journey and resonates with potential employers.

Work Experience Section for a Accountant Resume

The Work Experience section is a crucial component of your accountant resume. This section presents your professional journey and showcases your abilities in a structured manner.

How to Highlight Relevant Experience

To effectively highlight relevant experience, list your jobs in reverse chronological order. Start with your most recent position and work your way back. Each entry must include the job title, company name, dates of employment, and the location. This ensures potential employers easily identify your latest roles and responsibilities.

Consider emphasizing your roles in financial reporting, budgeting, or tax preparation. If you implemented a new accounting software, mention it. Include any cost-saving measures you initiated or insights you gained through auditing processes. Also, ensure you align your experiences with the job description to catch the employer’s attention immediately.

Examples of Impactful Bullet Points for Accountant Roles

Using bullet points can help clarify your achievements and responsibilities. Start with action verbs to make your contributions clear and compelling. Here are some impactful examples:

- Managed a team of three in the successful preparation of annual financial reports, which increased accuracy and reduced errors by 20%.

- Implemented a new budgeting process, leading to a 15% reduction in departmental expenditures over two years.

- Coordinated all aspects of financial audits, resulting in a 25% decrease in compliance issues year over year.

- Analyzed quarterly financial data to provide strategic insights, which contributed to a 10% growth in revenue during 2022.

Each bullet point tells a story of achievement that potential employers can easily understand. Quantifying your results enhances the impact. Did you save time and money? Did your analysis lead to a major business decision? These details add weight to your resume, making it stand out.

Highlighting Achievements Instead of Responsibilities

Focusing on achievements sets you apart in a competitive job market. Highlighting specific accomplishments makes your resume more impactful and demonstrates your unique value to employers.

Why Focusing on Accomplishments is Important

Demonstrating your value becomes crucial when competing for accountant positions. By emphasizing achievements, you quantify your contributions. Numbers grab attention. For example, stating that you “improved financial reporting accuracy by 30%” showcases your ability to yield results. Stand out by replacing generic phrases with concrete examples. Why list “responsible for accounts” when you can say “reduced account discrepancies by 25%, saving $94,000”? This specificity captivates hiring managers and clearly positions you as a candidate who adds measurable value.

Besides, achievements enhance your resume’s odds of passing through Applicant Tracking Systems (ATS). When you integrate relevant keywords from job descriptions into your accomplishments, those systems recognize your qualifications more effectively. Essentially, focusing on your achievements increases your visibility, making it easier for potential employers to see your fit for the role.

Examples of Achievements Relevant to Accountant

In the realm of accounting, achievements can take various forms. Here are some impactful examples:

- Cost Savings: “Identified inefficiencies in budgeting processes, resulting in cost savings of $100,000 annually.”

- Financial Reporting Enhancements: “Streamlined month-end closing procedures, reducing the time taken by 40%.”

- Tax Preparation Expertise: “Achieved a 15% reduction in client tax liabilities through strategic planning.”

- Audit Success: “Led audit teams that consistently received ‘no findings’ reports from external auditors over five consecutive years.”

- Software Implementation: “Implemented new accounting software that increased data processing efficiency by 25%.”

Each example conveys significant contributions clearly and concisely. What stands out? The measurable impact. Such details illustrate your ability to deliver results. Hence, consider integrating similar records of success into your resume to captivate potential employers effectively.

Education Section for a Accountant Resume

Creating a compelling Education section is vital for showcasing your qualifications. You must clearly present your academic credentials, demonstrating your readiness for an accounting role.

Recommended Qualifications

List your degrees prominently. A Bachelor’s or Master’s degree in Accounting, Finance, or a related field stands out. For example, you might include:

- Bachelor of Science in Accounting

- Master of Science in Finance

Certifications also add significant value. Highlight any relevant certifications, such as:

- CPA (Certified Public Accountant)

- CMA (Certified Management Accountant)

- CIA (Certified Internal Auditor)

- CFE (Certified Fraud Examiner)

- CGMA (Chartered Global Management Accountant)

- EA (Enrolled Agent)

Each of these qualifications signifies your expertise and commitment to the profession. Which certifications do you possess that set you apart?

How to Present Educational Background Effectively

When presenting your educational background, clarity works best. Start with your highest degree and work backward. Include essential details like the institution name, graduation date, and any honors received. Here’s a succinct format:

- Degree Title: Bachelor of Science in Accounting

- Institution Name: University of XYZ

- Graduation Year: 2022

If applicable, mention additional coursework that’s relevant. Did you take specialized classes in taxation or auditing? Such details convey your dedication to continuous learning.

Employ bullet points to enhance readability, ensuring that each entry is distinct. For example, you might list activities or relevant projects, such as:

- Completed a capstone project in financial analysis.

- Participated in a national accounting competition.

Using concise and precise language engages hiring managers, drawing their attention to your academic achievements. Keep this section updated, especially if you’re pursuing further education or certifications. Remember, every detail counts towards building your professional narrative.

Additional Sections for Accountant Resumes

Including additional sections on your accountant resume can significantly enhance its effectiveness. These sections provide insight into your qualifications, skills, and accomplishments, offering a comprehensive view of your professional profile.

Certifications

Certifications bolster your resume by demonstrating your commitment to the accounting profession. Highlight essential qualifications, such as CPA, CMA, CIA, or other relevant certifications. Listing these credentials not only showcases expertise but also emphasizes adherence to industry standards. Did you know that employers often prefer candidates with specific certifications? Including certification details—like certification dates and awarding bodies—can set your resume apart from others.

Languages

Highlighting language proficiency can provide you with a competitive edge, especially in multicultural environments. Speak multiple languages? Indicate your native language and any others you speak fluently or conversationally. For example, “Fluent in Spanish and conversational in French” conveys linguistic capabilities. This can be particularly attractive to firms serving diverse clientele or expanding globally. Why not showcase this valuable skill in your resume?

Awards and Honors

Awards and honors speak volumes about your professional accomplishments and recognition. If you received accolades for outstanding performance or contributions to the field, don’t hesitate to include them. Specific examples might include “Received the 2023 Employee of the Year Award for excellence in financial analysis.” Such distinctions demonstrate your value and highlight your commitment to high standards in your work.

Relevant Projects

Incorporating relevant projects can provide concrete evidence of your skills in action. When detailing these projects, focus on your role and the outcomes achieved. For instance, “Led a project that implemented a new budgeting system, resulting in a 20% decrease in unnecessary expenditures.” Such descriptions not only quantify your impact but also illustrate your ability to manage significant initiatives. Consider including those projects that align closely with the job description to further enhance your appeal.

By thoughtfully including these additional sections, you enhance the overall impact of your accountant resume, showcasing not just your qualifications but also your holistic value to potential employers.

Accountant Resume Sample

Creating a tailored accountant resume is essential in making a positive impression. Below is a sample format that demonstrates effective structuring and presentation of relevant information.

Contact Information

- Full Name: Alex Johnson, CPA

- Title: Senior Accountant

- Phone Number: (555) 123-4567

- Email Address: alex.johnson@email.com

Summary

Dedicated CPA with over 8 years of experience in financial reporting and compliance. Proven track record in streamlining operations, improving efficiency, and enhancing financial accuracy. Excels in high-pressure environments while maintaining meticulous attention to detail.

Work Experience

Senior Accountant

ABC Financial Services, New York, NY

June 2020 – Present

- Managed financial reporting processes for over 50 clients, ensuring compliance with GAAP.

- Developed budgeting strategies, resulting in a 15% reduction in departmental costs.

- Led a team of junior accountants, providing training in tax preparation and audit processes.

- Enhanced financial accuracy through the implementation of a new accounting software system.

Accountant

XYZ Corporation, Los Angeles, CA

January 2017 – May 2020

- Prepared quarterly tax returns, achieving a 95% accuracy rate under tight deadlines.

- Conducted audits for various departments, identifying discrepancies and suggesting improvements.

- Analyzed financial data to support strategic decision-making, directly contributing to revenue growth.

- Collaborated with cross-functional teams to ensure compliance with internal controls.

Education

Bachelor of Science in Accounting

University of Southern California, Los Angeles, CA

Graduated: May 2016

Certifications

- Certified Public Accountant (CPA)

- Certified Management Accountant (CMA)

Additional Skills

- Proficient in QuickBooks, Microsoft Excel, and financial modeling

- Strong analytical skills and problem-solving abilities

- Adaptable to new software and technologies in the finance sector

- English (Native)

- Spanish (Fluent)

This sample encapsulates the various components of a well-designed accountant resume. Following this structure and focusing on detailed achievements and skills enhances your marketability in a competitive job market. Tailor each section to fit your experiences and the specific positions you’re targeting.

Tips for Optimizing Your Accountant Resume for ATS

Improving your accountant resume’s chances of passing through an Applicant Tracking System (ATS) requires strategic approaches. Applying effective keywords and avoiding common mistakes can significantly enhance your application’s visibility.

How to Use Keywords Effectively

Using keywords effectively is crucial. Begin by analyzing the job description and identifying key terms related to your role. For instance, if the position emphasizes “financial reporting,” ensure this phrase appears prominently in your resume. Incorporating action verbs, such as “analyzed,” “managed,” or “prepared,” enhances keyword optimization. Also, consider including variations of keywords, like “tax preparation” alongside “tax compliance.” Use these phrases naturally throughout your professional summary, work experience, and skills sections to improve relevance. Remember, ATS systems scan for specific terms to match your qualifications with job requirements.

Avoiding Common ATS-Related Mistakes

Avoiding common ATS-related mistakes can make a significant difference in your application’s success. First, steer clear of using complex formatting, such as tables or images, which ATS might struggle to read. Stick to standard fonts and simple bullet points instead. Next, ensure your resume includes relevant sections, like “Work Experience,” “Education,” and “Skills.” Neglecting these categories may hinder the ATS’s ability to categorize your information properly. Check for misalignments in your experiences; if they don’t correlate with the job descriptions, reconsider their placement. Finally, maintain an appropriate length; one to two pages is ideal for most accountant resumes. By adhering to these guidelines, you’ll maximize your chances of standing out in the competitive accounting job market.

Common Mistakes to Avoid in a Accountant Resume

Creating an accountant resume for 2024 requires attention to detail and strategic thinking. Avoid these common mistakes to enhance your chances of landing an interview.

Lack of Specific Metrics and Quantifiable Achievements

Including quantifiable achievements is crucial. If your resume states “managed accounts,” it doesn’t convey the impact of your contributions. Instead, write, “corrected account errors, saving a total of $94,000.” With this approach, employers grasp the value you bring. Highlight metrics like “reduced audit prep time by 20%” to showcase efficiency. Such specifics can differentiate you from other candidates.

Failure to Match Skills with the Job Description

Matching your skills with those outlined in the job description is essential, especially in today’s competitive market. Carefully read the job listing and integrate relevant skills, such as “financial reporting,” “tax preparation,” or “proficiency in QuickBooks.” These skills aren’t just essential—they help your resume pass through Applicant Tracking Systems (ATS) that many companies use to filter applicants. Use exact phrases mentioned in the listing to enhance compatibility. By aligning your qualifications with the employer’s needs, you’ll catch the eye of hiring managers.

Ignoring Formatting and Layout

Professional appearance matters. A cluttered or overly complex resume can distract from your achievements. Choose a clean, easy-to-read format. Use standard fonts, adequate spacing, and clearly defined sections to present information. Instead of lengthy paragraphs, employ bullet points for organization. This method not only improves readability but also allows hiring managers to quickly identify your qualifications.

Overlooking Spelling and Grammar Errors

Even minor mistakes can create a negative impression. Ensure you proofread your resume multiple times. Also, consider enlisting a colleague or using grammar-checking software for an extra layer of review. Spelling errors and poor grammar signal a lack of attention to detail, a critical trait for accountants.

Providing Irrelevant Information

Include only information that directly relates to the position. Listing unrelated work experiences can dilute your key achievements. For instance, a brief mention of a part-time job during college might not be relevant if it doesn’t show transferable skills. Focus on experiences that align with the job description. Highlight roles in financial reporting or tax preparation to emphasize your fit for the accounting profession.

Neglecting the Summary Section

The summary section serves as your first impression. Avoid generic descriptions; instead, craft a concise summary that encapsulates your skills and accomplishments. Tailoring this section for each application can significantly bolster your appeal. Introduce phrases that demonstrate your qualifications, such as “dedicated accountant with five years of experience in financial reporting.” This targeted approach sets a strong tone for the rest of your resume.

Avoid these common pitfalls while crafting your accountant resume. Such strategic choices will enhance your presentation and increase your chances in a competitive landscape.

Cover Letter Tips for Accountant

A well-crafted cover letter enhances your resume by showcasing your writing skills and personality. It provides an opportunity to explain why you’re the ideal fit for the position and how you align with the company’s goals.

How to Write a Cover Letter That Complements Your Resume

Begin your cover letter with a strong opening that grabs attention. Address the hiring manager directly and mention the specific position you’re applying for. Tailor your letter to each job description. Use relevant keywords and phrases that reflect the role. Discuss your most significant achievements in accounting to demonstrate how you can add value.

Focus on highlighting your technical and soft skills. Describe experiences that showcase your analytical abilities, attention to detail, and effective communication. Incorporate specific metrics, like increasing efficiency by 30% in tax reporting. This not only adds credibility but provides a clear illustration of your impact.

Keep your cover letter concise. Aim for a length of no more than one page. Organize your thoughts logically, ideally aligning skills and experiences with the job responsibilities listed. Use clear, active language throughout, and avoid jargon. By emphasizing your qualifications and sincere interest in the role, you create a favorable first impression.

Cover Letter Example for an Accountant

[Your Name]

[Your Address]

[City, State, Zip]

[Your Email]

[Your Phone Number]

[Date]

[Hiring Manager’s Name]

[Company’s Name]

[Company’s Address]

[City, State, Zip]

Dear [Hiring Manager’s Name],

I’m excited to apply for the Accountant position at [Company’s Name], as advertised on [Job Board/Company Website]. With a Bachelor’s degree in Accounting and over five years of experience in financial analysis, I can offer a wealth of expertise. At [Previous Company Name], I enhanced reporting processes, resulting in a 20% reduction in report preparation time.

My proficiency in QuickBooks and Microsoft Excel ensures I deliver accurate financial data promptly. Also, my collaborative approach and problem-solving skills have contributed to successful cross-functional team projects. I’m adept at presenting complex financial information clearly, allowing stakeholders to make informed decisions.

I’m drawn to [Company’s Name] because of your commitment to innovation and excellence in financial services. I’m looking forward to discussing how my background aligns with your objectives. Thank you for considering my application.

Best regards,

[Your Name]

This example illustrates a tailored approach, focusing on relevant experiences and skills. Adapt your cover letter for each application, emphasizing not just qualifications but also alignment with the company’s mission.

Key Takeaways

- Standout Resumes: In 2024, effective accountant resumes require a compelling narrative that highlights unique skills and accomplishments rather than merely listing qualifications.

- Key Accountant Responsibilities: Focus on essential tasks such as financial reporting, budgeting, tax preparation, auditing, and financial analysis to showcase alignment with industry standards.

- Emphasize Skills: Blend technical skills (e.g., proficiency in accounting software) with soft skills (e.g., problem-solving and communication) to demonstrate your value to potential employers.

- Importance of Certifications: Relevant certifications like CPA or CMA greatly enhance credibility and career prospects, showcasing commitment and industry knowledge.

- Effective Resume Formats: Utilize the right resume template (chronological, functional, or combination) based on your career situation to effectively present your qualifications and experiences.

- Tailored Content: Customize your resume summary and work experience to match specific job descriptions to improve visibility and capture the interest of hiring managers.

Final Thoughts

Crafting an effective accountant resume in 2024 is all about showcasing your unique value and skills. By focusing on achievements and tailoring your resume to each job application, you can significantly enhance your chances of standing out in a competitive market.

Remember to highlight both technical and soft skills while ensuring your resume is optimized for Applicant Tracking Systems. Don’t underestimate the power of a well-structured cover letter to complement your resume and present your personality.

Stay committed to continuous learning and professional development to keep your qualifications sharp. With these strategies in mind, you’ll be well-equipped to navigate the evolving landscape of accounting and secure the opportunities you deserve.

Frequently Asked Questions

What should I include in my accountant resume?

Your accountant resume should include a concise summary, work experience in reverse chronological order, education, certifications, and relevant skills. Focus on specific achievements rather than just duties to showcase your unique value.

How can I make my accountant resume stand out?

To make your resume stand out, tailor it to the job description, highlight quantifiable achievements, and use a clear, professional format. Incorporate keywords that align with what employers are looking for, particularly in the accounting field.

What are the key skills needed for an accountant?

Key skills for accountants include technical skills like proficiency in accounting software and GAAP knowledge, as well as soft skills such as effective communication, problem-solving, attention to detail, and organizational abilities.

Why are certifications important for accountants?

Certifications, such as CPA or CA, demonstrate expertise and commitment to the profession. They help enhance your marketability and show potential employers that you are dedicated to continuous professional development.

What types of resume templates are best for accountants?

The best resume templates for accountants include chronological, functional, and combination templates. Choose one that best showcases your experience and skills depending on your career history and specific job situation.

How should I write an effective resume summary?

An effective resume summary should be concise, focus on your achievements rather than responsibilities, and incorporate relevant keywords from job descriptions. Tailor it to each application to highlight your most applicable skills and experiences.

How can I improve my resume for Applicant Tracking Systems (ATS)?

To improve your resume for ATS, use straightforward formatting, avoid graphics, and include relevant keywords derived from job descriptions. Make sure to cover all essential sections for better visibility.

What common mistakes should I avoid when creating an accountant resume?

Avoid common mistakes like neglecting to include specific metrics, failing to match skills with job descriptions, inconsistent formatting, and typos. Ensure your resume is professional, relevant, and tailored to the position you’re applying for.

How important is the Education section in an accountant’s resume?

The Education section is crucial as it highlights your academic credentials and relevant certifications. Clearly present your degrees and any specialized coursework to showcase your dedication to the field and continuous learning.

What additional sections can enhance my accountant resume?

Consider adding sections for certifications, language proficiency, awards, and relevant projects. These can help illustrate your accomplishments, demonstrate your commitment, and create a more compelling professional profile for potential employers.