Imagine stepping into a world where your financial expertise shines brighter than the competition. In 2024, the landscape for financial advisors is evolving rapidly, and your resume needs to reflect that shift. With new skills and technologies emerging, it’s crucial to craft a document that not only showcases your qualifications but also tells your unique story.

As you prepare to navigate this competitive field, you’ll discover that a well-structured resume is your key to unlocking opportunities. This guide will provide fresh insights and practical tips to help you stand out in a crowded marketplace. Get ready to transform your resume into a powerful tool that resonates with potential employers and highlights your value in the ever-changing financial advisory landscape.

Key Responsibilities of a Financial Advisor

As a financial advisor, you hold a pivotal role in guiding clients through their financial journeys. You provide tailored advice and strategies to help individuals and businesses achieve their financial objectives.

Your core responsibilities encompass several critical areas:

- Client Assessment: Engage with clients to understand their financial situations, goals, and risk tolerances. This foundational step helps in crafting customized financial plans.

- Portfolio Management: Develop and manage client investment portfolios. You must analyze market trends and make informed adjustments based on economic conditions. This approach ensures optimal asset performance.

- Financial Planning: Create comprehensive financial plans, which may include retirement planning, tax strategies, and estate planning. The complexity of these plans requires a deep understanding of various financial products and regulations.

- Ongoing Monitoring and Review: Conduct regular reviews of client portfolios. It’s essential to communicate changes in market conditions and adjust strategies accordingly. Keeping clients informed fosters trust and strengthens relationships.

- Regulatory Compliance: Adhere to regulatory requirements and industry standards. This responsibility includes keeping accurate records and ensuring that all client transactions comply with established laws.

- Client Education: Educate clients about financial products and investment strategies. Empathizing with their concerns and answering questions helps them feel confident in their financial decisions.

Reflect on your previous achievements. What quantifiable results can you showcase? Perhaps you’ve increased client portfolio growth by 20% or saved clients thousands in tax liabilities.

Eventually, your role as a financial advisor revolves around providing valuable insights, maintaining strong client relationships, and ensuring that financial goals are met efficiently. Your expertise not only enhances your clients’ financial well-being but also solidifies your standing in a competitive market.

Important Skills for Financial Advisor Resumes

Highlighting the right skills on your financial advisor resume can significantly impact your appeal to potential employers. Candidates who effectively showcase both technical and soft skills, along with relevant certifications, demonstrate a well-rounded profile.

Technical Skills

Technical skills play a crucial role in your ability to provide valuable financial advice. Proficiency with financial planning software, such as MoneyGuidePro and eMoney Advisor, enhances your ability to create comprehensive plans tailored to client needs. Experience with tools like QuickBooks and the EDGAR Database reflects strong financial analysis capabilities. Familiarity with portfolio management software positions you as a knowledgeable resource in investment analysis.

Data analysis also stands out as an essential skill. You must adeptly gather and analyze data to create insightful financial reports. Leveraging tools like MS Project and Salesforce streamlines your data management processes. Can you imagine how effective communication with clients becomes through timely reports and dashboards?

Soft Skills

While technical expertise is vital, soft skills are equally important in building robust client relationships. Excellent communication skills enable you to explain complex financial concepts clearly and calmly. Empathy sets you apart; understanding client needs fosters trust. You might excel at negotiating, which can lead to favorable outcomes for your clients.

Problem-solving abilities shine in challenging situations as you help clients overcome financial obstacles. With a keen sense of adaptability, you can navigate the ever-changing financial landscape. Your ability to listen actively often uncovers underlying client concerns that require attention. Isn’t it reassuring to know these skills positively influence your effectiveness as a financial advisor?

Certifications and Relevant Qualifications

Certifications bolster your resume, showcasing commitment and expertise in the financial sector. Credentials like Certified Financial Planner (CFP) or Chartered Financial Analyst (CFA) signify a high level of proficiency. Employers regard these qualifications as assurance of your capability to handle client portfolios responsibly.

Staying current with educational opportunities enhances your marketability. Each certification you pursue adds depth to your knowledge base, allowing you to cater to diverse client needs. Consider this: Continuous education not only elevates your skills but also demonstrates your dedication to professional growth. Emphasizing these certifications on your resume conveys to employers that you are prepared for the challenges of the financial advisory landscape in 2024.

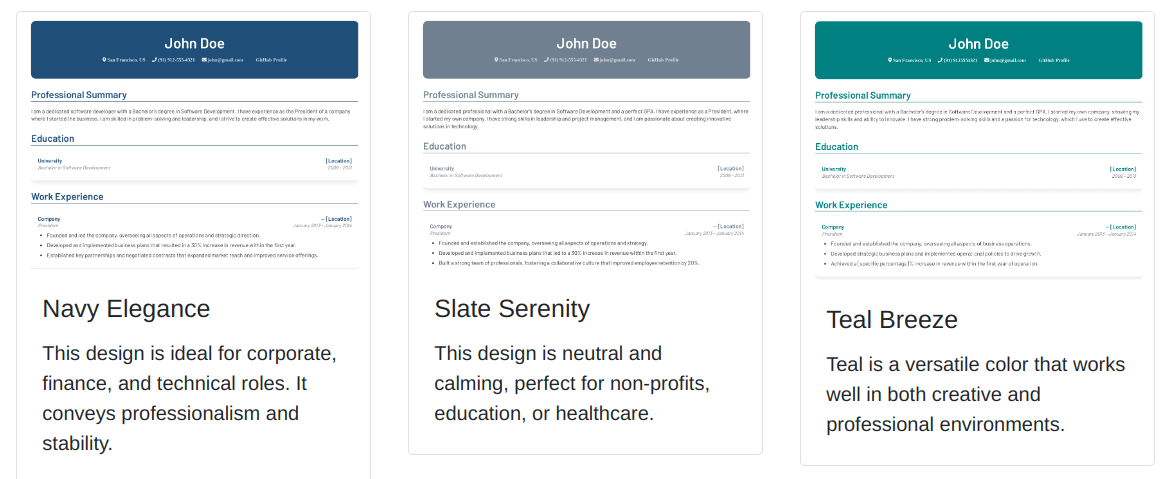

Types Of Resume Templates For Financial Advisors

Choosing the right resume template can significantly impact your chances of getting noticed in a competitive landscape. Financial advisors can select from several effective formats, each designed to highlight your unique skills and experiences.

Chronological Resume Templates

Chronological resume templates are ideal for showcasing your career progression. This format emphasizes your work history, listing your most recent job first and working backward. Often, financial advisors use it to highlight a solid track record in the industry. If you have 10-15 years of experience, this layout allows you to demonstrate your growth and accomplishments clearly. Effective use of this template reveals not just your job titles but also reflects the evolution of your skills over time. Highlighting your experience in client portfolio management or regulatory compliance can attract potential employers’ attention.

Functional Resume Templates

Functional resume templates focus on skills and qualifications, rather than strictly following your career timeline. This format works well for entry-level candidates or individuals experiencing employment gaps. You can emphasize your expertise in financial planning software or your strong communication skills, drawing attention away from gaps in your work history. By foregrounding your skills, you create an opportunity to connect your abilities to the needs of potential employers. This type of resume allows you to present your qualifications distinctly, making your strengths stand out.

Combination Resume Templates

Combination resume templates merge the benefits of both chronological and functional styles. They allow you to highlight relevant skills while also showcasing your professional experience in a cohesive manner. This structure is especially effective for mid-career financial advisors, enabling you to communicate your versatility and adaptability. You might start with a skills section that outlines your qualifications, followed by a detailed employment history. Such an approach gives you flexibility, making it easier to align your background with the specific requirements of the job you’re targeting. It effectively tells a story, showcasing how your skills translate into real-world achievements.

Selecting the right template aligns with your career stage and highlights your experience. Each template serves a unique purpose, making it essential to choose one that best showcases your strengths and meets the expectations of potential employers.

How to Write an Effective Resume Summary for a Financial Advisor

Crafting an effective resume summary serves as a critical component of your application. This section acts as your elevator pitch, capturing essential skills and experiences succinctly.

Tips for Crafting a Compelling Summary

Tailoring your summary to the job description stands paramount. Study the posting closely; understand what specific skills or qualifications the employer values. Mention your job title first, followed by your years of experience in the financial field. You might state, “Dynamic Financial Advisor with over 10 years of experience.” That sets the tone immediately.

Highlight key qualifications and use metrics to showcase achievements. Instead of merely listing duties, focus on the impact you’ve had—clients can sense genuine results. For instance, if you’ve managed assets exceeding $25 million, make this known. It establishes credibility.

Also, emphasize your ability to work closely with clients, providing them with valuable financial insights. Describe how your expertise in portfolio management led to a 20% growth in client investments, reinforcing your capabilities.

- “Results-driven Financial Advisor with 15 years of experience in building client relationships and achieving measurable results. Managed client assets totaling $30 million and consistently received satisfaction ratings above 95%.”

- “Experienced Financial Advisor specializing in comprehensive financial planning and asset management. Proven track record of achieving client objectives; guided clients through complex financial decisions, resulting in annualized portfolio growth of 18%.”

- “Detail-oriented Financial Advisor with a decade of experience in tax optimization and investment strategies. Successfully enhanced client portfolios by an average of 25% over three years while adhering to regulatory compliance standards.”

Each example showcases distinct styles. Focus on your strengths and adapt your summary accordingly. Creativity in this section can set you apart from the competition, making it vital to present your unique story effectively.

Work Experience Section for a Financial Advisor Resume

The Work Experience section plays a significant role in your financial advisor resume, showcasing your relevant experience and achievements. This section provides potential employers with a detailed view of your professional journey.

How to Highlight Relevant Experience

Tailoring your resume to match the job description is vital. Focus on the duties and achievements that align directly with the financial advisor role you’re pursuing. Use the reverse-chronological format, listing your most recent positions first, which makes it easy for hiring managers to see your career progression. Limit the experience to the past 10-15 years; this timeframe offers a snapshot of your most relevant positions without overwhelming the reader.

Consider employing action verbs like “managed,” “developed,” and “advised” to begin each bullet point. Doing so creates a sense of impact and engagement. Remember, it’s not just about tasks; it’s about results. Quantify your accomplishments wherever possible. For example, did you increase client retention rates by 20% over a year? Did you help clients save $50,000 in taxes? Specific figures make your contributions stand out and provide a tangible illustration of your ability.

Examples of Impactful Bullet Points for Financial Advisor Roles

Creating strong bullet points can define your resume. Here are compelling examples that effectively convey achievements:

- Advised a diverse clientele on comprehensive financial plans, resulting in a 30% increase in overall portfolio performance over two years.

- Managed relationships with over 100 clients, achieving a 90% satisfaction rating through dedicated communication and tailored investment strategies.

- Developed innovative retirement plans that led to a 15% growth in new client acquisitions and boosted assets under management by $2 million.

- Coordinated quarterly financial reviews, which improved client retention by 25% and fostered long-term investing habits.

These bullet points are clear and to the point, showcasing your impact in previous roles. They demonstrate your skills while providing proof of your contributions to previous employers. Vary the wording and structure within your own points to maintain reader interest and showcase the breadth of your experience effectively.

Highlighting Achievements Instead of Responsibilities

Emphasizing achievements in your financial advisor resume proves critical in 2024. This strategy effectively showcases your unique value and distinguishes you from other candidates.

Why Focusing on Accomplishments is Important

Focusing on accomplishments demonstrates your value to potential employers. Each achievement reflects specific contributions that helped previous organizations grow or improve. Rather than listing generic responsibilities, you create an engaging narrative that captures attention. Did you increase client retention by 20% over two years? Did you lead a team that successfully launched a new investment strategy? These examples communicate your impact clearly.

Also, using quantifiable results in your resume establishes credibility. Instead of vague statements, numbers speak volumes. A hiring manager reviewing your resume notices performance metrics, making it easier for them to evaluate your potential. Demonstrating how your actions led to increased revenue or reduced costs shows your ability to deliver results.

When you provide concrete accomplishments, you also set yourself apart from competition. Many applicants rely solely on listing duties, which can make resumes blend into the background. By showcasing your success and dedication through specific examples, you become a standout candidate.

Examples of Achievements Relevant to Financial Advisor

Consider listing achievements such as:

- Client Portfolio Growth: Achieved a 30% increase in client portfolio value over 18 months. This kind of growth reflects your financial expertise and understanding of market strategies.

- Regulatory Compliance Success: Played a key role in ensuring 100% compliance with new industry regulations, safeguarding the firm from penalties. Effective compliance speaks to your diligence and attention to detail.

- Client Acquisition: Successfully acquired 50 new clients within one year, contributing to a significant expansion in the firm’s client base. This achievement highlights your networking and communication skills.

- Process Improvement Initiatives: Developed and implemented a new client onboarding process that reduced client start time by 25%. This showcases your ability to enhance efficiency.

- Financial Education Workshops: Conducted monthly workshops that increased client engagement and satisfaction scores by 40%. Engaged clients demonstrate your commitment to their education and well-being.

By shifting focus to accomplishments, your resume transforms into a powerful tool that clearly illustrates to potential employers how you can add value to their organization. Remember, the key lies in detailing these achievements with specific metrics and descriptive phrases that demonstrate your journey and ultimate success.

Education Section for a Financial Advisor Resume

The education section of your financial advisor resume plays a critical role in showcasing your qualifications. Properly structured, this section can highlight your academic achievements and relevant certifications effectively.

Recommended Qualifications

A finance-related degree serves as a strong foundation. You might consider earning a Bachelor of Science in Business Administration with a finance concentration or pursuing a master’s degree in finance or business administration. Beyond degrees, special certifications stand out prominently. For instance, obtaining the Certified Financial Planner (CFP) or Chartered Financial Analyst (CFA) designations reflects commitment and expertise in financial planning and analysis. Also, possessing FINRA licenses, such as Series 7, demonstrates regulatory compliance knowledge and enhances your credibility. These qualifications not only set you apart in a competitive market, but they also convince potential employers of your capability to advise clients effectively.

How to Present Educational Background Effectively

Presenting your educational background requires careful attention to detail. Start with your most recent degree or certification, providing the name of the institution, location, and graduation date. For example, “Master of Business Administration, University of California, Los Angeles, 2022” clearly conveys your education and emphasizes your academic achievements. Consider using bullet points to list relevant coursework or honors; this draws attention and allows for quick scanning.

In cases where education is significant due to lack of experience, position the education section at the top of your resume. This strategy highlights your academic accomplishments right away. Remember to include any ongoing education or professional development courses, as they signal an eagerness to grow in the profession. Use phrases like “Continuing Education” or “Professional Development,” followed by the name of the course and completion date. By highlighting these elements, you create a well-rounded picture of your dedication to the field.

Summarizing, a well-structured education section can enhance your financial advisor resume significantly. Focus on presenting your qualifications clearly, showcasing both degree and certification achievements to attract employer interest.

Additional Sections for Financial Advisor Resumes

Including extra sections on your financial advisor resume can significantly enhance your appeal to potential employers. These sections provide opportunities to showcase qualifications, experiences, and unique skills.

Certifications

Certifications serve as vital endorsements of your expertise in the financial advisory field. You should prominently display key certifications, such as:

- Certified Financial Planner (CFP): This credential signifies your proficiency in personal financial planning.

- Chartered Financial Analyst (CFA): This prestigious designation demonstrates your ability in investment management.

- Financial Industry Regulatory Authority (FINRA) Licenses: Licenses like Series 7 indicate your qualification to trade securities.

Position these certifications in a dedicated section on your resume. By doing so, you underline your commitment to professional development and compliance with industry standards. Do your certifications reflect your targeted role?

Languages

If you are multilingual, include a ‘Languages’ section to highlight this capability. Proficiency in additional languages can open doors to diverse clientele and global firms. For example, fluent communication in Spanish or Mandarin may attract clients seeking personalized service.

Mention your language skills succinctly, specifying levels of proficiency, such as conversational or fluent. Wouldn’t you want to engage a broader client base?

Awards and Honors

Incorporating awards and honors into your resume can set you apart from other candidates. Accomplishments, such as “Top Financial Advisor of the Year” or specific recognition from professional organizations, showcase your dedication and success in the field.

Consider presenting these accolades chronologically or in order of significance, giving hiring managers a quick grasp of your achievements. Which award represents a milestone in your career?

Relevant Projects

Highlighting relevant projects can illustrate your hands-on experience and problem-solving skills. This section allows you to detail:

- Client Portfolio Management: Showcase specific instances where your strategies led to measurable growth.

- Financial Planning Initiatives: Describe how you developed plans that improved clients’ financial situations.

- Compliance Projects: Emphasize your role in implementing policies that ensured regulatory adherence.

Using descriptive phrases, articulate the impact of each project on your client base and firm. For instance, detailing a project that resulted in a 20% increase in client retention makes your achievements tangible. What projects have had the most significant impact on your career?

By thoughtfully incorporating these additional sections, you create a comprehensive picture of your qualifications. Each segment plays a critical role in positioning you as a well-rounded financial advisor ready to tackle the challenges of 2024 and beyond.

Financial Advisor Resume Sample

Here’s an illustrative example of a financial advisor resume structured for clarity and impact:

[Your Name]

[Your Address]

[City, State, Zip]

[Your Email] | [Your Phone Number] | [LinkedIn Profile or Portfolio Link]

Summary

Accomplished financial advisor with over 7 years of experience in wealth management and client relationship enhancement. Demonstrated success in increasing client portfolio growth by an average of 15% annually. Committed to providing comprehensive financial planning services and maintaining compliance with regulatory standards.

Experience

Senior Financial Advisor

[Company Name], [City, State]

[Month, Year] – Present

- Managed client portfolios totaling over $50 million, achieving a 20% increase in returns over two years.

- Developed tailored financial strategies for over 200 clients, focusing on retirement planning and investment growth.

- Established strong relationships through effective communication and regular financial reviews.

- Led a team of junior advisors in client acquisition initiatives, contributing to a 30% rise in new accounts.

- Streamlined client onboarding processes, reducing onboarding time by 40%.

- Advised clients on compliance issues, ensuring adherence to industry regulations and standards.

Financial Advisor

[Previous Company Name], [City, State]

[Month, Year] – [Month, Year]

- Assisted in managing investment portfolios worth up to $30 million, with consistent annual returns of 10-12%.

- Conducted in-depth financial assessments and risk analyses, resulting in optimized investment decisions.

- Facilitated client seminars that educated over 100 participants on investment strategies and market trends.

- Enhanced existing client relationships by providing personalized financial advice and review services.

- Collaborated with investment teams to stay abreast of market developments, adapting strategies promptly.

- Tracked client satisfaction metrics, achieving a 95% satisfaction rate through proactive engagement.

Education

Bachelor of Science in Business Administration (Finance)

[University Name], [City, State]

[Year of Graduation]

Certifications

- Certified Financial Planner (CFP)

- Chartered Financial Analyst (CFA)

- [Other Relevant Certification]

Skills

- Proficient in financial planning software, such as [Specific Software Names].

- Exceptional communication and interpersonal abilities.

- Strong analytical skills for risk assessment and investment strategies.

- Comprehensive knowledge of regulatory compliance and financial regulations.

- Multilingual: [Languages Spoken].

- Recognized as Top Financial Advisor in [Year] by [Awarding Organization].

- Received Excellence in Client Service Award from [Previous Company Name] in [Year].

By crafting your resume with attention to achievements and qualifications, you create a powerful tool that conveys professionalism and showcases your expertise. Prioritize clarity, relevance, and impact to stand out in a competitive field.

Tips for Optimizing Your Financial Advisor Resume for ATS

To enhance your chances of landing an interview, focus on optimizing your financial advisor resume for Applicant Tracking Systems (ATS). Effective formatting, keyword use, and attention to detail serve crucial roles in this process.

How to Use Keywords Effectively

Keywords act as a bridge between your resume and the job description. Study job descriptions thoroughly and extract crucial terms to weave into your resume. For instance, if a position emphasizes “client portfolio management” or “financial planning,” make sure those phrases appear in your own descriptions of your work and achievements. Emphasizing relevant skills reinforces your suitability for the role.

Incorporating specific metrics strengthens your keyword usage. Rather than vague statements, quantify your achievements with actual numbers. Instead of saying “improved client satisfaction,” you might say, “increased client satisfaction by 30% over 12 months.” This detail not only highlights performance but also aligns with the preferred terminology.

Avoiding Common ATS-Related Mistakes

Avoid pitfalls that could undermine your ATS performance. First, steer clear of overly complex layouts. Use a clean, simple format with clear headings, as elaborate designs may confuse the ATS. Ensure that your resume is saved as a PDF; this preserves your format when processed by these systems.

Also, pay attention to font choices. Use modern, readable fonts like Rubik and Montserrat, with margins set to 1 inch all around. This ensures clarity and improves readability.

Also, refrain from using images and graphics. ATS platforms often struggle to interpret visual elements, which can lead to important information being overlooked. Keeping your resume text-based maximizes the chances of your qualifications and achievements being recognized by these systems.

By diligently applying these tips and strategies, your resume evolves into a compelling narrative that resonates with both ATS algorithms and human recruiters alike.

Common Mistakes to Avoid in a Financial Advisor Resume

When crafting a resume as a financial advisor, several mistakes can hinder your chances.

Lack of Clear and Concise Format

A clear format is vital. A cluttered resume distracts hiring managers. Make use of bold headings and bullet points to present information neatly. Keep it concise—one to two pages suffice based on your experience. Avoid overwhelming readers with excessive detail.

Vague or Generic Descriptions

Vagueness often leads to missed opportunities. Instead of stating duties, highlight specific achievements. Consider detailing results, like, “Increased client portfolio by 20% within one year.” Using concrete numbers demonstrates your impact. Achievements grab attention—yes, they can set you apart!

Ignoring Relevant Keywords

Employers frequently use Applicant Tracking Systems (ATS) to filter resumes. Keywords in job descriptions are essential to include. For example, terms like “financial planning,” “portfolio management,” or “regulatory compliance” resonate well with recruiters. Missing these keywords can result in your resume being overlooked.

Focusing Solely on Responsibilities

Resumes that merely list responsibilities lack impact. Highlight accomplishments instead. Illustrative examples include “Achieved a 99% customer satisfaction rating.” These accomplishments aren’t just statements; they’re compelling stories of success. They connect your past experiences to the employer’s current needs.

Neglecting the Education Section

Education deserves attention, especially for those seeking to stand out. List relevant degrees and certifications, such as a Bachelor’s in Finance or a CFP designation. When you position this section prominently, you emphasize your qualifications. A strong educational background enhances your appeal.

Omitting Additional Relevant Sections

Consider showcasing skills beyond the standard sections. Include certifications and licenses, like FINRA, for instance. Languages may also reflect your ability to connect with diverse clients. Incorporate awards to signify excellence in your field. These additional sections create a comprehensive view of your strengths.

Using Passive Language

Passive language can weaken your resume’s impact. Instead of saying “was responsible for managing client portfolios,” say “managed client portfolios.” Active voice communicates confidence and clarity. Strong language invites hiring managers to visualize your contributions.

Ignoring Proofreading

Typos and grammatical errors undermine professionalism. A resume filled with mistakes creates doubt. Take the time to proofread. Even better, have someone else review it—fresh eyes catch errors you might miss.

Avoiding these common pitfalls strengthens your financial advisor resume. Each mistake addressed elevates your profile and makes a lasting impression on potential employers.

Cover Letter Tips for Financial Advisor

Crafting a compelling cover letter is essential in highlighting your qualifications while complementing your resume. A well-structured letter can provide insights into your personality and approach, giving potential employers a glimpse of your value.

How to Write a Cover Letter That Complements Your Resume

To effectively write a cover letter, follow these essential steps:

- Personalize the Greeting: Address the hiring manager by name when possible. This approach shows your commitment and genuine interest in the position.

- Open with a Strong Introduction: Start with an engaging opening. Capture attention by stating why you’re excited about the opportunity or mentioning a relevant connection.

- Highlight Relevant Experience and Skills: Discuss key qualifications that make you an ideal candidate. Use specific examples from your career, such as “Managed $190M AUM” or “Increased client satisfaction ratings from 88% to 99.9%.” Such metrics provide concrete evidence of your contributions.

- Align with Company Values: Research the company’s mission and values. Explain how your experience aligns with their goals and how you can contribute to the team.

- Conclude with a Call to Action: Encourage further communication. Use a sentence like “I look forward to discussing how my skills can benefit your team.” This proactive step leaves a lasting impression.

Cover Letter Example for a Financial Advisor

Below is a tailored example of a cover letter for a Financial Advisor position:

[Your Name]

[Your Address]

[City, State, Zip]

[Your Email]

[Your Phone Number]

[Date]

[Employer’s Name]

[Company’s Name]

[Company’s Address]

[City, State, Zip]

Dear [Employer’s Name],

I am excited to apply for the Financial Advisor position at [Company’s Name], as advertised on [Job Board]. With over [X years] of experience in financial planning and investment management, I have a proven track record of helping clients achieve their financial goals. My passion for client success drives my dedication to providing personalized financial strategies.

In my previous role at [Previous Company], I managed $190M in assets under management, consistently exceeding performance benchmarks. By implementing tailored investment strategies, I increased client satisfaction ratings from 88% to 99.9%. I thrive on building strong client relationships, fostering trust, and delivering actionable insights. As a Certified Financial Planner (CFP), I am committed to ongoing education and excellence within the field.

At [Company’s Name], I admire your commitment to [specific values or initiatives]. My expertise aligns perfectly with your mission to enhance client financial security. I look forward to the opportunity to contribute my skills to your team and help elevate your clients’ financial futures.

I appreciate your consideration and look forward to discussing how my qualifications can meet the needs of your team.

Sincerely,

[Your Name]

Using these guidelines can elevate your cover letter, complementing your resume and setting you apart from the competition.

Key Takeaways

- Resume Structure: Choose the right resume format (chronological, functional, combination) to effectively highlight your skills and experiences, tailoring it to your career stage and targeted role.

- Highlight Key Skills: Emphasize both technical (financial planning software, data analysis) and soft skills (communication, empathy) that demonstrate your ability to build strong client relationships and provide valuable financial insights.

- Focus on Achievements: Showcase quantifiable accomplishments instead of generic responsibilities, using specific metrics to illustrate your impact (e.g., client portfolio growth, regulatory compliance success).

- Certifications Matter: Include relevant certifications (CFP, CFA) and licenses (FINRA) prominently, as they enhance your credibility and reflect your commitment to professional development in the financial advisory sector.

- Tailor Your Resume Summary: Craft a compelling resume summary tailored to the job description, clearly stating your experience, key qualifications, and the measurable impact you’ve had in previous roles.

- Optimize for ATS: Use relevant keywords from job postings and maintain a clean, straightforward format to improve your resume’s performance with Applicant Tracking Systems, ensuring that crucial information is recognized by hiring managers.

Final Thoughts

Crafting a standout resume as a financial advisor in 2024 is essential for navigating the competitive job market. By focusing on your unique story and quantifiable achievements you can create a compelling narrative that resonates with potential employers. Highlighting relevant skills certifications and your educational background will further enhance your appeal.

Don’t underestimate the power of a well-structured resume tailored to the specific job you’re targeting. Remember to optimize for ATS and avoid common pitfalls to ensure your qualifications shine through. With these strategies in mind you’re well on your way to transforming your resume into a powerful tool for career advancement. Embrace the opportunity to showcase your expertise and dedication as you pursue new professional horizons.

Frequently Asked Questions

What are the key responsibilities of a financial advisor?

Financial advisors primarily focus on assessing client needs, managing investment portfolios, developing financial plans, monitoring progress, ensuring regulatory compliance, and educating clients about their financial options. These responsibilities require strong interpersonal skills and a commitment to client success.

Why is it important for financial advisors to update their resumes in 2024?

Updating resumes allows financial advisors to reflect new skills, certifications, and technologies relevant to the evolving financial landscape. A current resume helps showcase qualifications and tells a unique story, making advisors stand out in a competitive job market.

How should financial advisors highlight their skills on their resumes?

Financial advisors should differentiate between technical skills (like financial planning software proficiency) and soft skills (such as communication and empathy). Highlighting relevant certifications, such as CFP or CFA, also demonstrates expertise and commitment to professional growth.

What types of resume templates are best for financial advisors?

Chronological templates emphasize career progression, while functional templates concentrate on skills. Combination templates serve mid-career professionals well by showcasing both experience and skills. Choosing the right template is crucial for effectively presenting qualifications.

How can financial advisors enhance their resume summary?

Financial advisors should tailor their summary to align with job descriptions, emphasizing key qualifications and using metrics to highlight achievements. A compelling summary can effectively convey the advisor’s unique story and draw the employer’s attention.

What should financial advisors include in their Work Experience section?

Advisors should tailor their experience to match job descriptions, using a reverse-chronological format. Limiting the timeline to the past 10-15 years, and utilizing impactful action verbs with quantifiable accomplishments will illustrate their contributions effectively.

Why is it important to focus on achievements rather than responsibilities in a resume?

Highlighting achievements demonstrates the value an advisor can bring to potential employers, creating a narrative that captures attention. By using quantifiable results, advisors can showcase their success and differentiate themselves from other candidates.

How should financial advisors present their education on a resume?

Financial advisors should list their most recent degrees and certifications clearly, ideally situated at the top if the education is particularly significant. Including finance-related degrees and relevant certifications like CFP or CFA is essential for showcasing qualifications.

What additional components can enhance a financial advisor’s resume?

Key components include certifications, languages, awards, and relevant projects. Highlighting certifications like CFP and CFA, foreign language skills, awards, and hands-on project experience can create a comprehensive view of qualifications and expertise.

What are some common mistakes to avoid when writing a financial advisor resume?

Advisors should avoid vague job descriptions, a lack of quantifiable achievements, and overly complex formats that could confuse Applicant Tracking Systems (ATS). Ensuring clarity, using active language, and proofreading thoroughly are essential for a professional presentation.